Ct Tax Table 2025 2025. Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000 ($80,000 for married filing joint) will. 1, 2025, reducing taxes for taxpayers by approximately $460.3 million.

The 3% rate on the first $10,000 earned by single filers and the first $20,000 by joint filers will drop to 2%. The guide includes the legislative changes to 2025 withholding calculations rules and withholding tables, the reduced rates for certain income taxes, and revisions to.

The 5% rate on the next $40,000 earned by single filers and the next $80,000 by joint filers will drop to 4.5%.

20242024 Tax Calculator Teena Genvieve, 9,14,469 crore (net of refund) and personal. Effective january 1, 2025, the first $10,000 ($20,000 for married filing joint) will be taxed at 2%, down from 3%, the next $40,000 ($80,000 for married filing joint) will.

Tax rates for the 2025 year of assessment Just One Lap, The connecticut tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in connecticut, the calculator allows you to calculate. Connecticut state income tax tables in 2025.

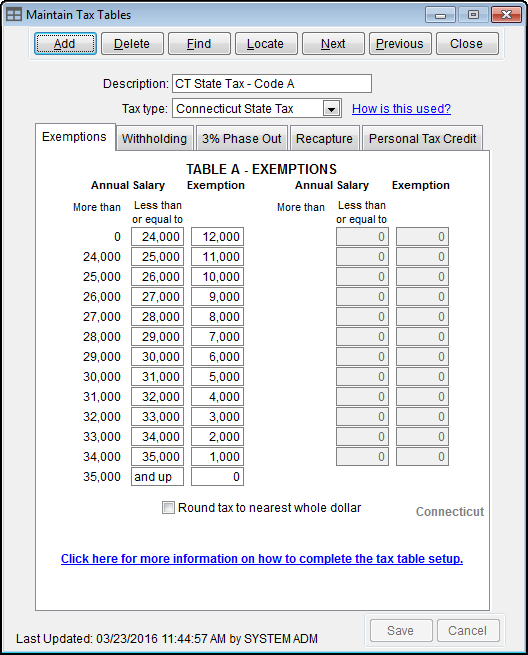

Connecticut Tax Withholding Tables Elcho Table, The 5% rate on the next $40,000 earned by single filers and the next. The net direct tax collection of rs.

Maximize Your Paycheck Understanding FICA Tax in 2025, The 5% rate on the next $40,000 earned by single filers and the next. From 3% to 2% for individuals with connecticut.

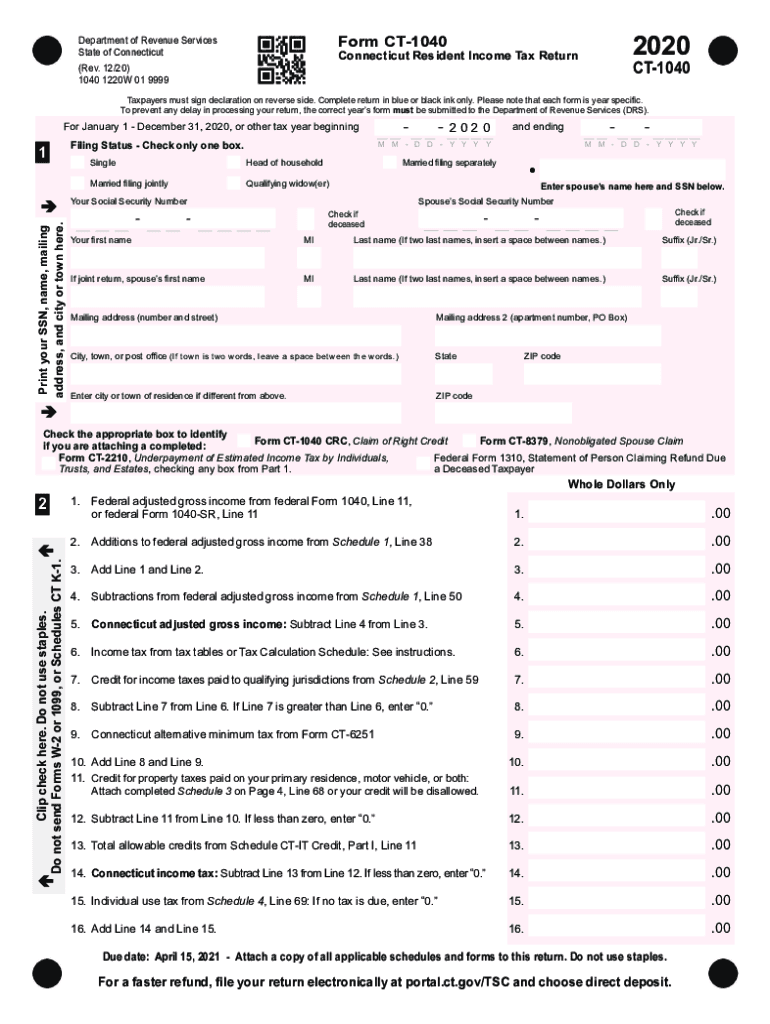

Ct tax forms Fill out & sign online DocHub, Each marginal rate only applies to earnings within the. Changes to connecticut’s income tax that take effect jan.

Ct 1040 Fill out & sign online DocHub, Connecticut has seven marginal tax brackets, ranging from 3% (the lowest connecticut tax bracket) to 6.99% (the highest connecticut tax bracket). 9,14,469 crore (net of refund) and personal.

Tax Withholding Tables For Employers Elcho Table, The 3% rate on the first $10,000 earned by single filers and the first $20,000 by joint filers will drop to. 1, 2025, affect its withholding tables and calculation rules, the state’s department of revenue services.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, 9,14,469 crore (net of refund) and personal. Ct employer’s tax guide connecticut income tax withholding requirements taxpayer information is available on our website at portal.ct.gov/drs ip 2025(1) withholding.

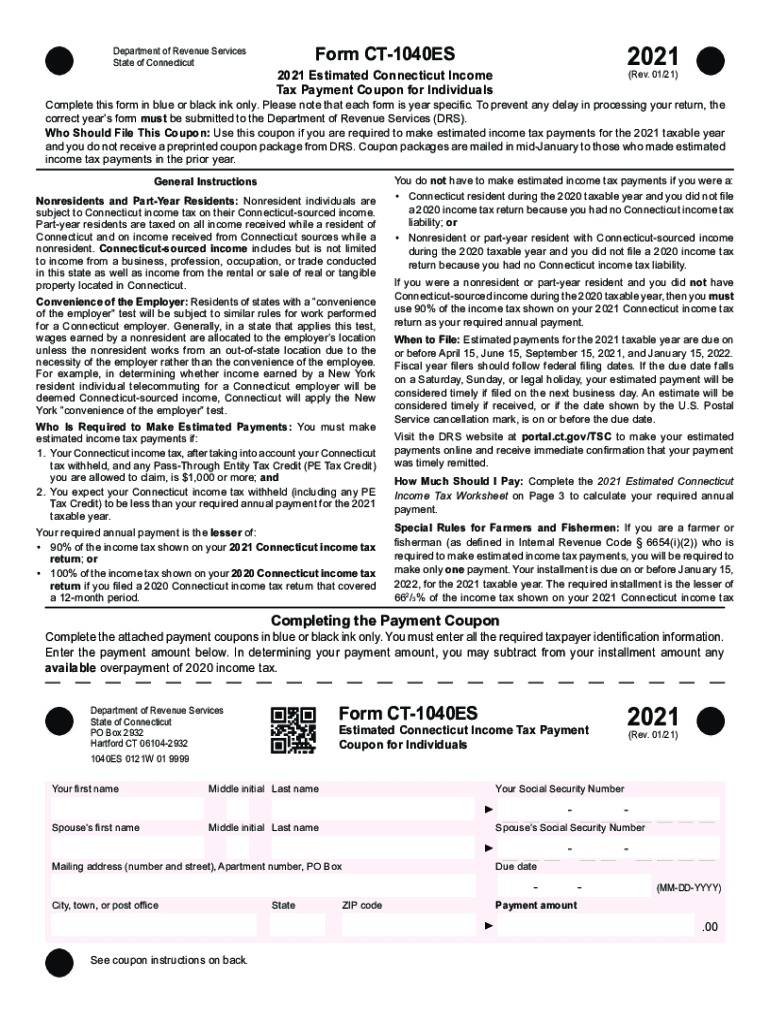

2025 Tax Brackets The Best To Live A Great Life, 1, 2025, affect its withholding tables and calculation rules, the state’s department of revenue services. Estimated tax payments for tax year 2025.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg)

2025 Tax Rate Schedule Irs TAX, Changes to connecticut’s income tax that take effect jan. Social security benefit adjustment worksheet.